Ns payroll deductions calculator

Plus 175 on the next 57000. This guide calculates the deductions tables using the dynamic.

Breakdown Of Canadian Payroll Taxes For Us Companies

You can use the calculator to compare your salaries between 2017 and 2022.

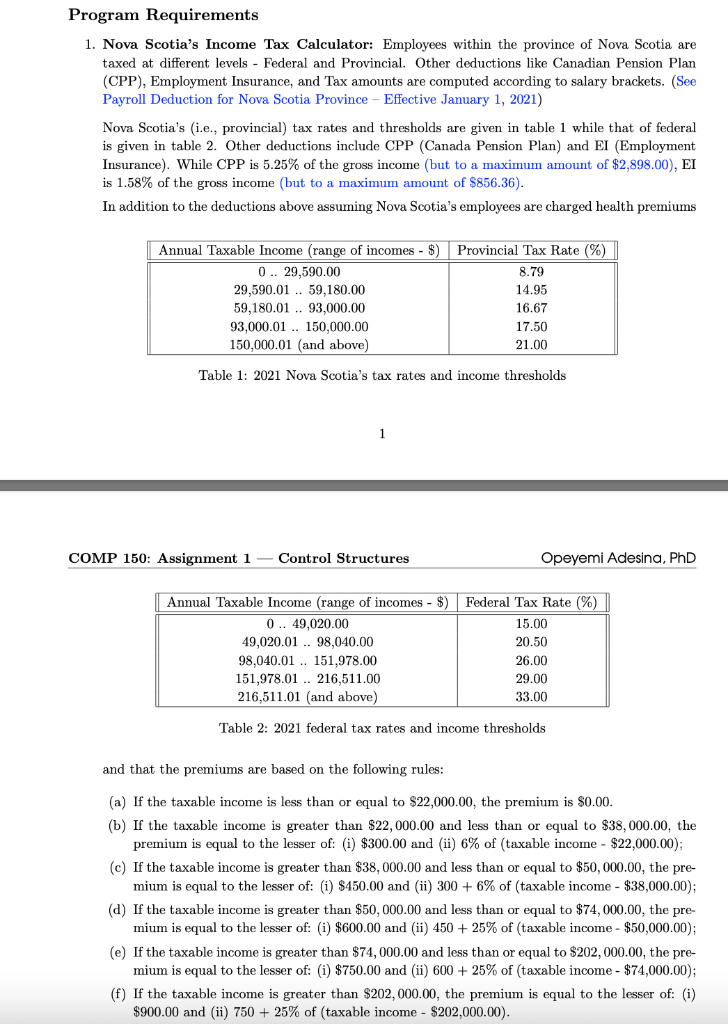

. The regular portion is 8 481 and Nova Scotia offers an enhancement of 3000 for 25 000 and less of taxable salary and roll-off at a rate of 6 of taxable income until 75 000. Plus 1667 on the next 33820. How to use a Payroll Online.

Ad Compare This Years Top 5 Free Payroll Software. Form TD1-IN Determination of Exemption of an Indians Employment Income. Ad Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties.

You can enter your current payroll information and deductions and then compare them to your. Try changing your with-holdings filing status or retirement savings and. The online calculator makes it easier to calculate payroll deductions.

PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Start setting up Gusto for free and dont pay a cent until youre ready to run payroll.

Youll pay a tax rate of 879 on the first 29590 of taxable income. In Nova Scotia your take-home pay is calculated by taking your annual pre-tax or gross salary and subtracting federal taxes and provincial taxes applied by Nova Scotia. Use this calculator to help you determine the impact of changing your payroll deductions.

Start Afresh in 2022. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Free Unbiased Reviews Top Picks.

A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec. The online calculator makes it easier to calculate payroll deductions. For example if you earn 2000week your annual income is calculated by.

Plus 1495 on the next 29590. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Ad Streamline your payroll benefits onboarding and integrations all in one place.

PDOC is available at canadacapdoc. Discover ADP Payroll Benefits Insurance Time Talent HR More. PDOC is available at canadacapdoc.

Find Easy-to-Use Online Payroll Companies Now. Ad Process Payroll Faster Easier With ADP Payroll. For your 2022 payroll deductions you can use our Payroll Deductions Online Calculator PDOC.

Ad See the Payroll Tools your competitors are already using - Start Now. PDOC is available at canadacapdoc. Ad Payroll Doesnt Have to Be a Hassle Anymore.

The online calculator makes it easier to calculate payroll deductions. You can enter your current payroll information and deductions and then compare them to your proposed deductions. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

This online calculator makes it easier to calculate payroll deductions. Full payment flexibility for your team across 120 currencies and 10 payment methods. Ad Streamline your payroll benefits onboarding and integrations all in one place.

PDOC calculates payroll deductions for the most common pay. T4032NS Payroll Deductions Tables - CPP EI and income tax deductions - Nova Scotia - Effective January 1 2022 Notice to the reader Publication T4032 Payroll Deductions Tables is. Nova Scotia Salary Calculation - Create and Email The following tool will allow you to create a salary illustration for Nova Scotia and then send this to yourself a friend colleague employee.

2022 Payroll Deduction Table for Nova Scotia CFIB To help you out with payroll deductions weve prepared a summary chart including all the 2021 rates for CPP EI taxes etc. Start setting up Gusto for free and dont pay a cent until youre ready to run payroll. No Need to Transfer Your Old Payroll Data into the New Year.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Use this simplified payroll deductions calculator to help you determine your net paycheck. All Services Backed by Tax Guarantee.

Read reviews on the premier Payroll Tools in the industry. PDOC calculates payroll deductions for the most common pay periods as. The calculator is updated with the tax rates of all Canadian provinces and.

Get Started With ADP Payroll. Plus 21 on the. You can enter your current payroll information and deductions and.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

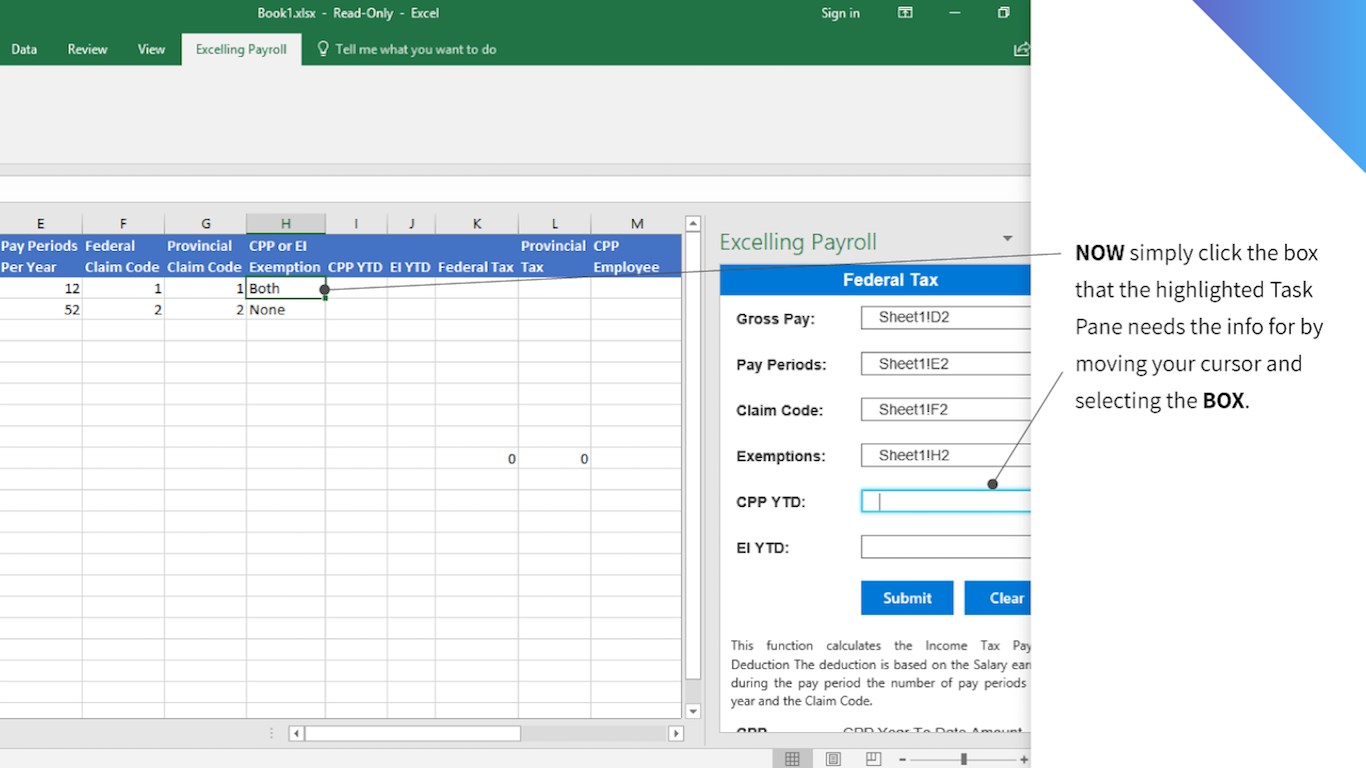

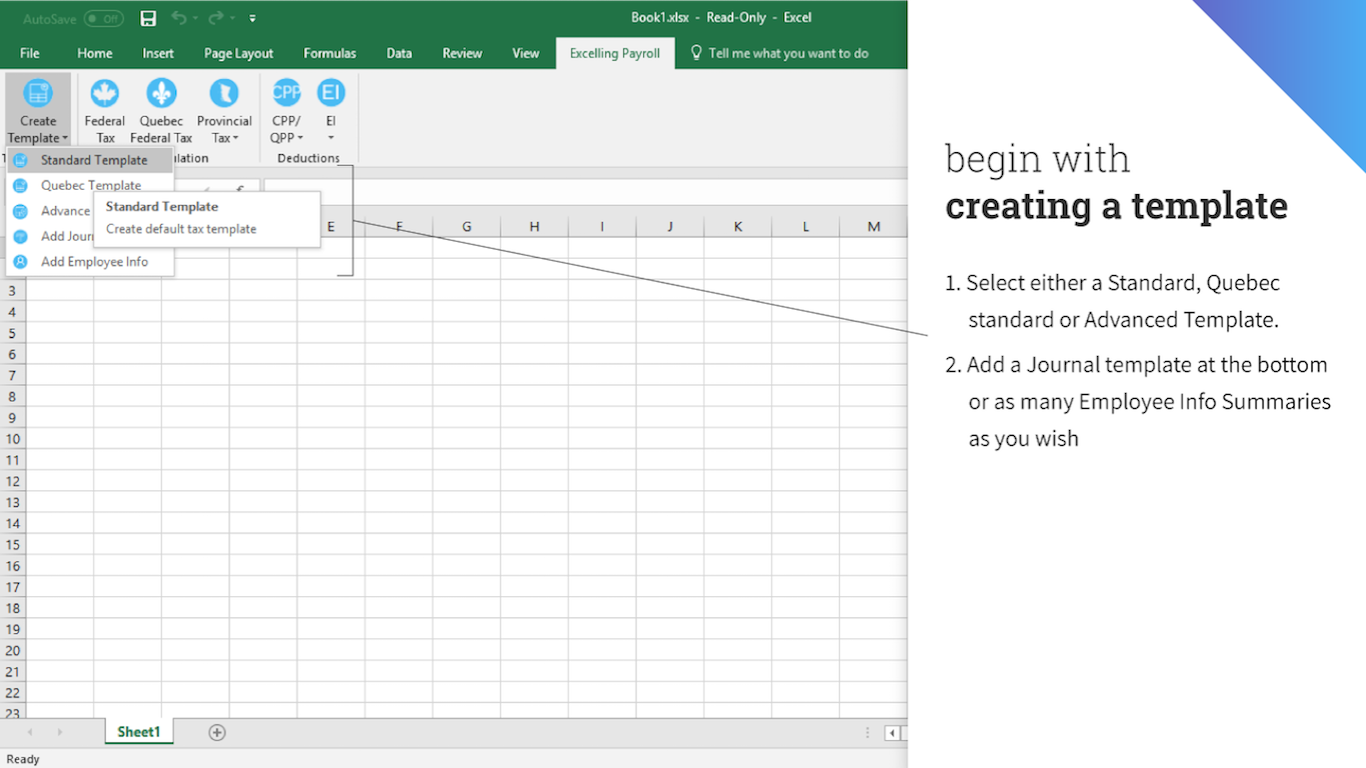

Find The Right App Microsoft Appsource

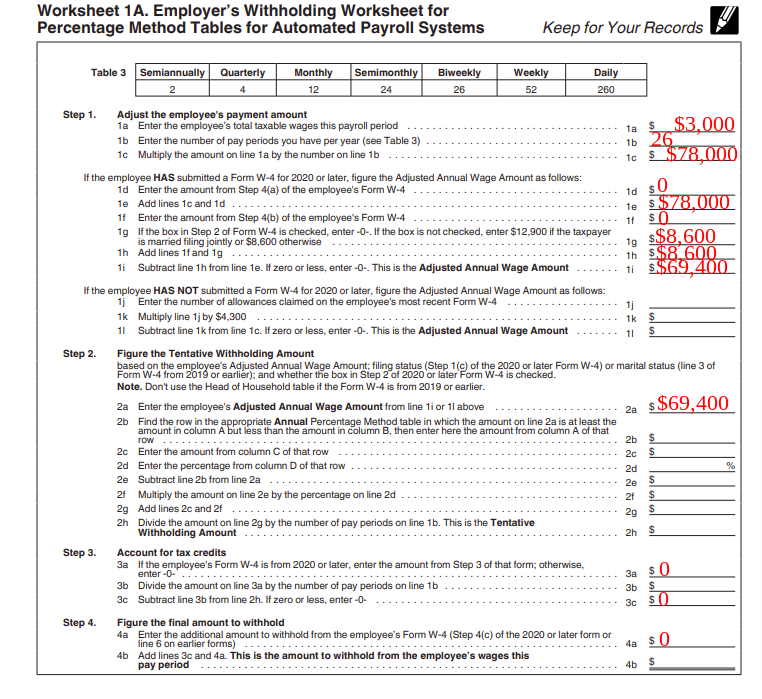

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

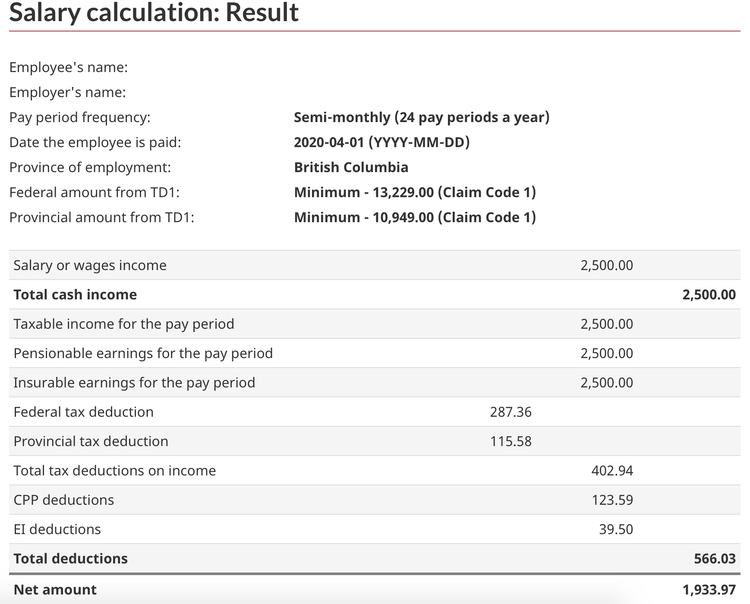

How To Do Payroll In Canada A Step By Step Guide

Canadian Payroll Vs U S Payroll What S The Difference Updated 2020

Standard Deductions Youtube

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

How To Calculate Payroll Taxes Methods Examples More

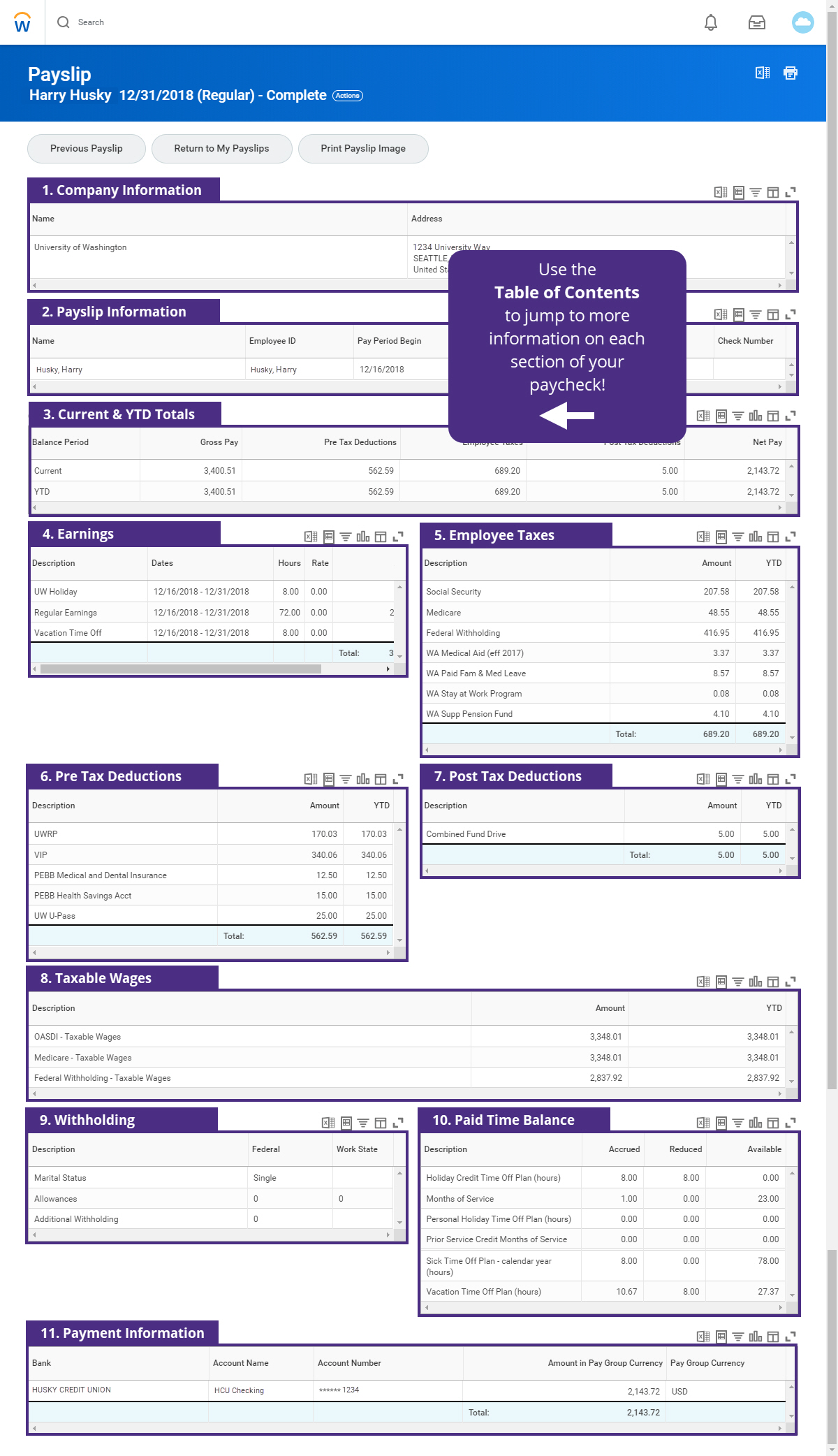

How To Read Your Payslip Integrated Service Center

Solved Nova Scotia S Income Tax Calculator Employees Within Chegg Com

Payroll Transactions Help Center

Find The Right App Microsoft Appsource

Excel Payroll Template

Confluence Mobile Support Wiki

Payroll Transactions Help Center